Whatever your financial goals are – getting out of debt, saving for early retirement, buying a house, or just creating more financial peace – managing your money with intention makes all the difference.

So what are the basics of intentional money management? Tracking expenses and incomes, setting money aside for taxes, budgeting and aligning your spending to your budget – to name a few elements.

Long gone are the days where you would need a physical notebook to track your finances (like characters from 19th century novels), or a handheld calculator, or an old-fashioned spreadsheet in your computer.

I have been using Notion for tracking my expenses and budgeting for years, and I want to share my personal finance template with you, so that you can stay on top of your finances too!

It’s a combined tool to track your income, expenses and budgets. And it’s adjustable to your living situation – you can use it alone or with a partner in case if you share your finances (the data will stay in sync between your devices as long as you are online).

So let’s dive into the details!

- Why use a financial tracker

- Problems with personal finance tracking

- Solution – personal finance template in Notion

- How to use this personal finance template

- Benefits of tracking your money

- What next…

Why use a financial tracker

So why should you use a financial tracker and budgeting tool? In the realm of personal finance, you can only manage what you measure.

It doesn’t take much for money to slip through your fingers. But it does take effort to take control over your finances and make it work for you and your goals.

Usually, tracking income is easier than tracking expenses. Transactions are not that numerous and it’s nice seeing money coming in.

Tracking expenses is much more tricky because it might bring out uncomfortable feelings of guilt, shame, or regret. That’s why people often fail at tracking expenses and turn a blind eye on their finances – until it’s too late.

I know very well that feeling of terror when I would look into my bank account only to realise I had no money left, long before my next pay check would come in.

Anxiety, shame and guilt, stress and despair were my frequent emotional struggles. And nobody deserves to live with these feelings!

Even if seems intimidating at first, facing reality and addressing money issues is the first and necessary adult step towards a healthy financial future.

In case if looking into your bank account statements is terrifying, using a financial tracker on a regular basis will gradually take the overwhelm away. It will simply become a habit to look and see how you are doing financially.

Moreover, you will be able to easily analyse any aspect of your personal finance, see where you can cut your expenses and create more margin for savings, set money away for taxes or detect if you are falling to lifestyle creep.

Tracking money should be an indispensable part of your financial routine, no matter if you are struggling or are good with money, or what season of life you are in.

Problems with personal finance tracking

Over the years I’ve encountered the following problems with managing my expenses and budgeting:

- It takes too much effort to make an entry in a financial tracker. Especially if it’s a paper-based one.

- I used a simple notebook back in 2015 while I was a uni student to track all expenses – from buying stationery to meals at the canteen. My ‘finance tracker’ was bulky, I didn’t always carry it with me, and collecting receipts and making entries at home after the fact was too much extra effort and time.

- Mobile apps are usually too rigid and do not provide enough flexibility. Plus they come with paid features.

- I like flexibility, and I refuse to pay for features (unless it is something that provides a huuuge value).

- Making entries for the sake of making entries and never analysing them doesn’t change anything in my financial reality.

- If you make entries of your expenses and never learn or take actions to improve your finances, you are not creating any difference.

- Using expense tracking feature of a banking app doesn’t provide a full picture.

- Well, obviously – because it doesn’t take into account your cash expenses and other bank accounts. So having a consolidated database is a must.

Solution – personal finance template in Notion

My free Notion finance tracker solves all these problems, and I’ve been using it myself for years.

Notion is great as it provides endless possibilities for customisation. It doesn’t take much to adjust a financial template to your needs – something that no financial tracking app can do.

It takes a couple of taps on your smartphone to enter an expense, reducing the friction and making the expense tracking habit stick.

Also you have a budget tracker built into this template and it automatically checks if you are sticking to the budget or if you have overspent.

Check it out and try yourself!

How to use this personal finance template

To start:

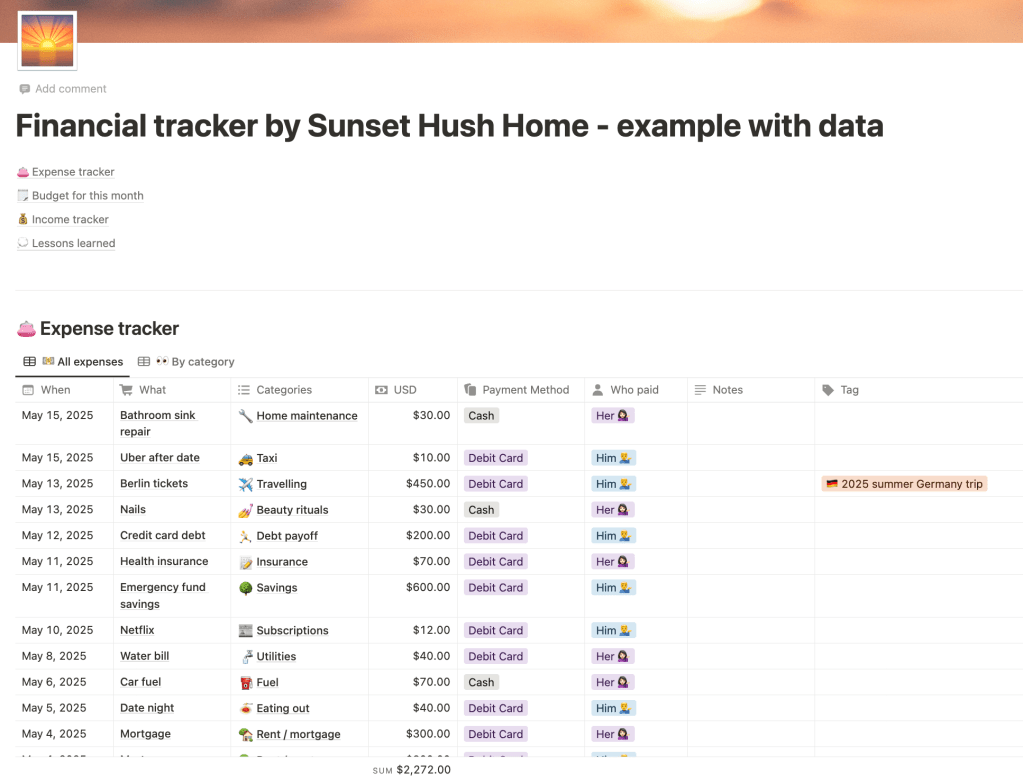

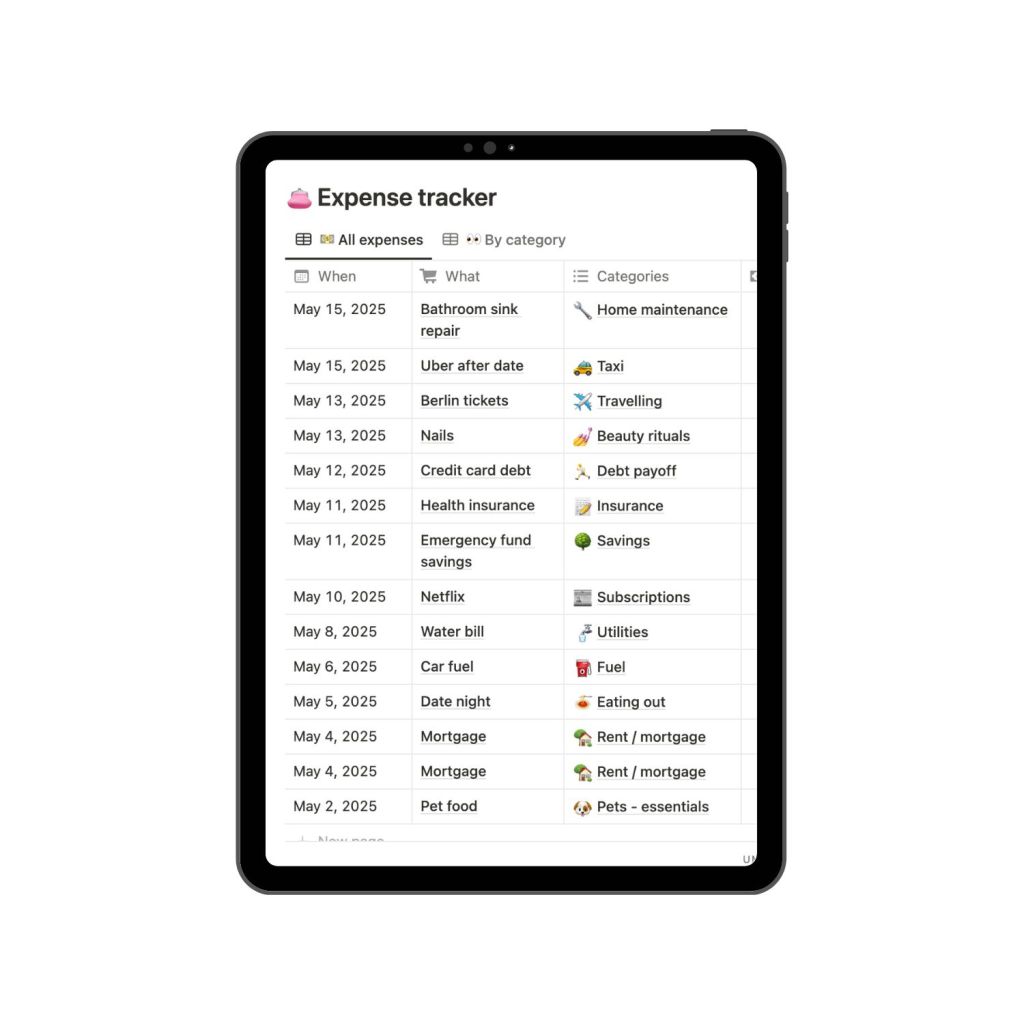

1. Take a look at an example with already provided data to see what it can look like.

2. Open the actual empty template and duplicate it to your Notion.

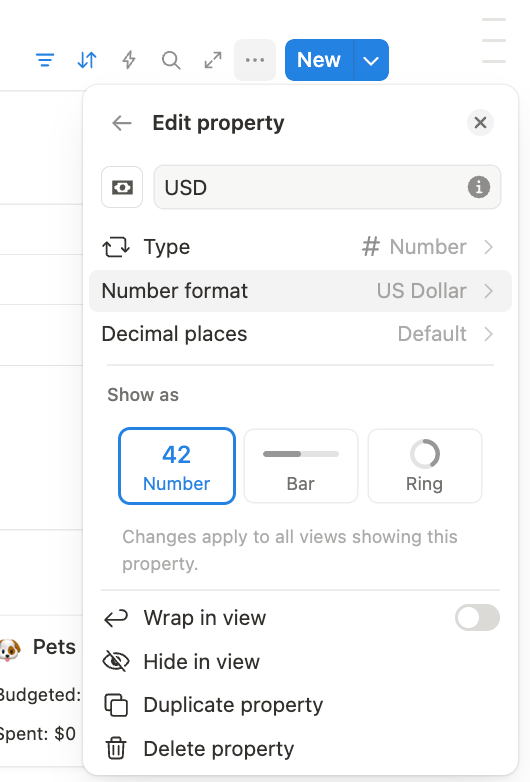

3. If your currency is different from USD, select your currency for each number field (go to Edit property → Number format). Leave it as “Number” if your currency is not in the list. Then go to Budget for this month → Gallery view, click on a displayed property and edit the formula to show your currency.

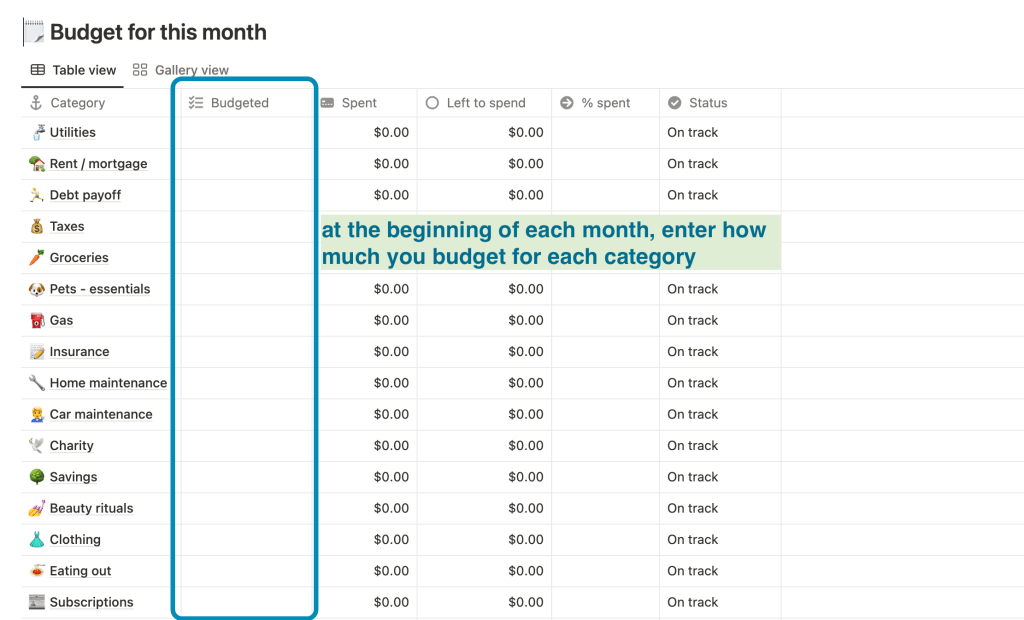

4. Adjust budget categories to your liking in the “Budget for this month” table.

5. Enter your budget for each category for this month. Be sure to update it each month.

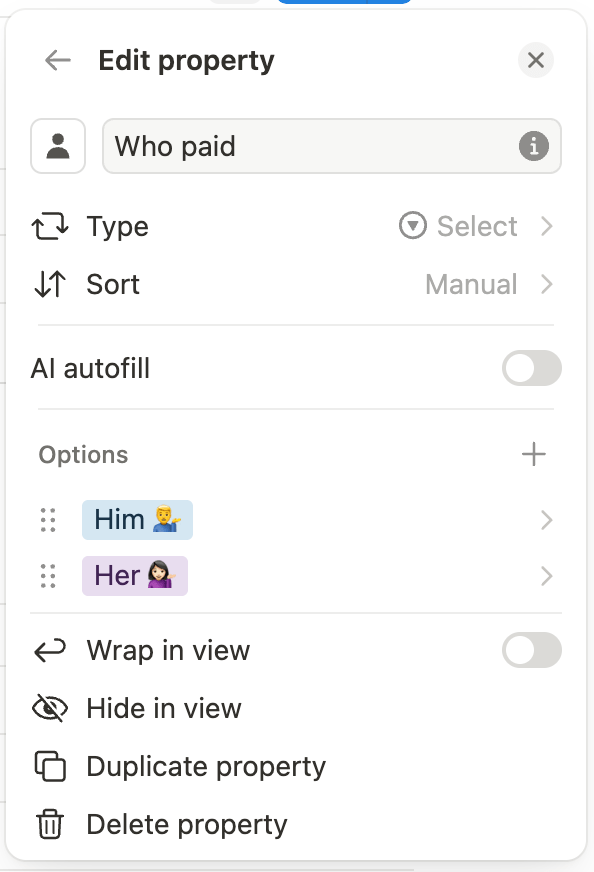

6. In the “Expense tracker”, adjust the members of your household under “Who paid”. Or hide or remove this property if you are managing your finance alone.

7. Invite members to use the tool through a shared Notion space.

8. Add a widget for this page to your smartphone homescreen, so that you can quickly access the tracker and enter your expenses as you go.

As you go:

- Whenever you have a new expense, open the Notion app through the widget and make a new entry in your “Expense tracker” database.

- I really recommend doing it the moment you make a payment and not postpone entering expenses until evening / weekend / end of month. Adding expenses after the fact can be a long, tedious and error-prone task. And it’s a quick and simple habit to track expenses as you go, so why not do this right away?

- Add your income by going to “Income tracker” and tapping “New”. You can create any tags you need to specify the income source.

- If you want to track expenses for a specific occasion or project, you can add new values in the “Tag” property of the “Expense tracker” database.

- Your expenses (applicable to the current month) will be automatically added up under “Spent” in the “Budget for this month” database.

- Put any money wisdom that you have learned from your own experience or from other people under “Lessons learned”.

- You can hide properties on each view of the databases to adjust them to your liking.

At the end of each month:

- Sit down and take a look at your expenses. Involve your partner, if applicable.

- Analyse:

- where you overspent and what you can do to avoid overspending in the future;

- where you did well and what helped you.

- Write down the learnings under “Lessons learned”.

- See if you need to adjust your budget for different categories.

- Do not be too strict and unrealistic with your budgets. Create a budget that actually works.

Visual adjustments you can make:

- Update the name of the page, the icons and image at the top.

- You can make several blocks displayed side-by-side on a desktop. Just drag and drop the blocks as you want to see them.

Benefits of tracking your money

In case if it still feels complicated or intimidating, here are a few reasons why you SHOULD start managing your money with a finance tracker:

- You will understand how much you spend on what, getting visibility into your finances and reducing financial anxiety.

- Budgeting doesn’t have to be a restriction. On the contrary – it gives an immense freedom and makes you the master of your money. You will be adjusting your personal budget as you go, to make it work for you and your goals.

- Analysing your finance each month, you will find areas for improvement in your financial strategy.

- You will be able to plan how much you can save each month and build substantial savings.

- You will be making behavioural and mindset changes around money to achieve financial peace and reach your financial goals.

What next…

It’s not that hard to start taking control over your finances – just the right intention and the right tools, and it will become a habit.

With a consistent money tracking habit, you will see where you can cut expenses and where you can have margin to save more for what is truly important.

Find a good purpose for the saved money that aligns with your values. Enjoy knowing that even in case of a crisis you will be fine. And move towards the financial peace that you deserve.

Save the tracker to your Notion and let me know in the comments if your would like to see any additions to it!

Leave a comment